Cryptocurrency staking first exploded into popularity back in 2013 with the release of Peercoin — the first cryptocurrency based on the Proof of Stake (PoS) consensus mechanism.

Peercoin became the first prominent cryptocurrency to offer staking rewards to holders, allowing them to essentially lock up their coins to help secure the network, while receiving regular rewards for doing so.

Since the early days of staking, the industry has gone through a radical transformation in both the simplicity and availability of the practice, as Proof of Stake continues to grow in popularity, while an increasing number of cryptocurrencies can now be staked.

In this time, the way cryptocurrencies are staked and the rewards they pay out have changed drastically, making it more attractive than it has ever been. With that in mind, here’s how you can maximize your staking gains in 2020 and beyond.

An Overview of Staking

Staking is a simple process whereby a cryptocurrency holder commits to lock their coins or tokens up for a fixed period of time in order to benefit the security of the network. In return for this, they’ll receive incentives in the form of network rewards, either paid directly by the network itself, or by the validator nodes which the stake was delegated to.

The rewards you receive for staking typically depend on the amount you staked — staking more typically leads to greater staking rewards, similar to earning interest in a bank account. This process generally requires you to store your staking coins in a wallet with staking functionality, which may be either a full node wallet, a compatible third-party wallet, or most commonly on a pooled staking platform.

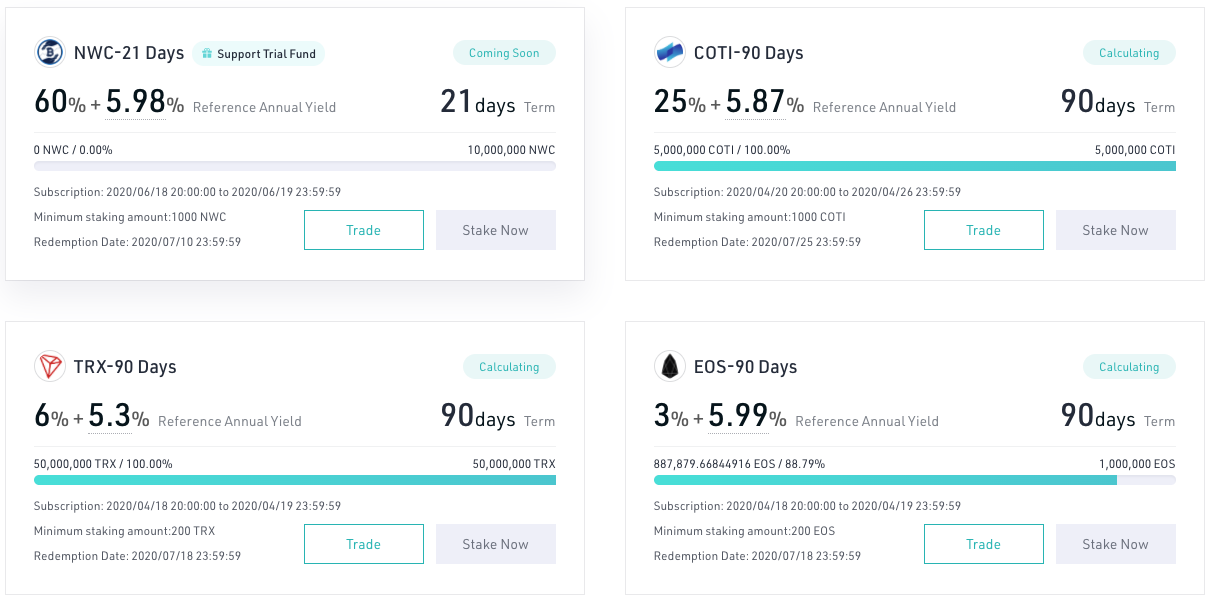

Without using any systems to boost your staking rewards, you’ll usually find that higher market cap cryptocurrencies pay less than smaller PoS coins — but there are exceptions. A rough guideline of 3 to 60% APR can be considered a reasonable return for most staking coins.

The amount you receive will also vary based on a variety of other factors, including the type of cryptocurrency you are staking; the proportion of coins you’re staking as a fraction of the total staked on that network, and potentially the length of time you commit your stake. If you’re staking using a delegated Proof of Stake (dPoS) coin, then you may also find that validators offer different returns, which can affect your APR.

Maximizing Staking Profitability

When it comes to boosting your staking profitability, beyond simply increasing your staked amount or choosing a more generous validator, there are two mains ways to go about this.

Arguably the simplest way to do this is to register for a fixed staking product, many of which allow you to earn far more than the standard staking rate thanks to promotions being run by the staking provider or cryptocurrency project.

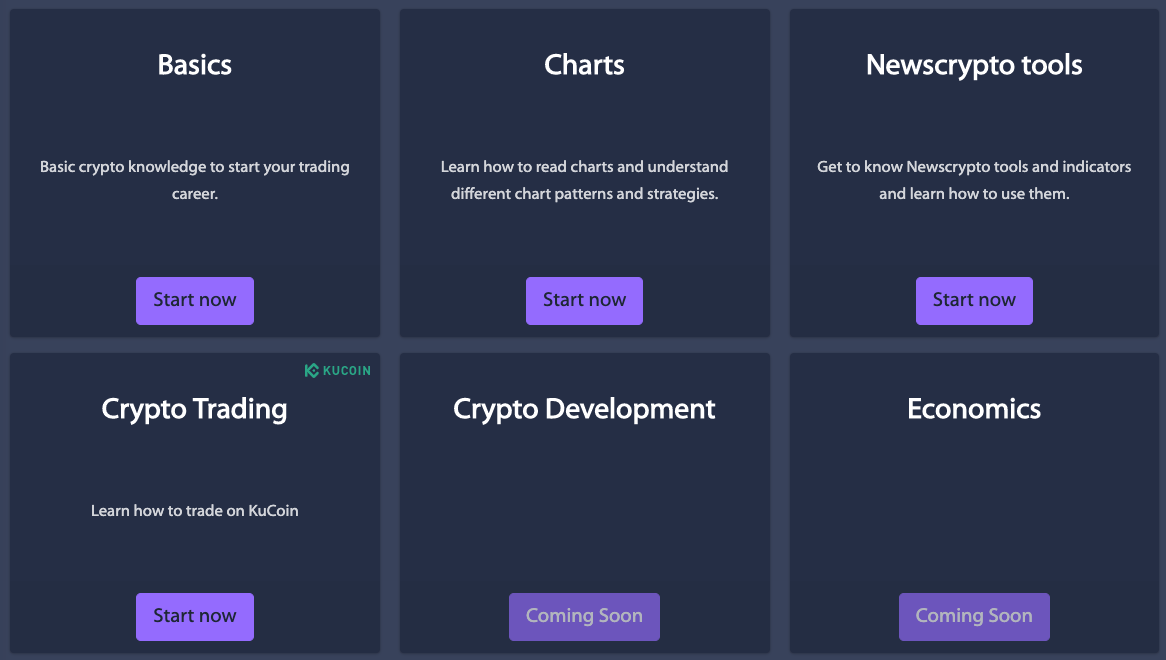

For example, the up-and-coming cryptocurrency education platform NewsCrypto recently partnered with KuCoin’s Pool-X platform to launch a promotion offering as much as 60% APR for NewsCrypto (NWC) token holders, with an additional 5.97% bonus paid in POL tokens. This, combined with an upcoming NewsCrypto quiz gives participants the opportunity to earn one of the highest APRs ever offered by a staking product.

As we briefly touched on, cryptocurrency staking usually entails locking up your cryptocurrencies for a fixed period of time. During this time, you are unable to access your assets for spending or trading purposes. However, Pool-X recently became the first platform to allow stakers to access their cryptocurrencies for trading purposes with its unique redemption feature. This can allow you to trade your coins, potentially allowing you to grow your investment even faster.

Choosing the most rewarding staking coin is one of the simplest ways to generate a better yield. This can vary over time, so it’s wise to keep track of the major offerings to see which one is currently the most profitable. Although it can be tempting to pick one and stick with it, switching it up every now and then can hedge your risks and potentially boost your profits.

Image(s): Shutterstock.com