- Why major crypto exchanges are not the silver bullet?

- What services do smaller scale exchanges win over their larger counterparts?

-

A boutique approach proves to be more inclusive and sometimes more efficient than a mass-market approach. This is also true for the crypto space.

The crypto exchanges space has been under scrutinize and debate for quite a while now. Let’s face it: this is not solely for the security issues. The convenience and user experience leave much room for improvement. Now, in 2018 major crypto exchanges may have reached relatively large trading volumes and liquidity amounts, yet they are far from becoming universal all-in-one solution for each and every user’s demand.

While pro-traders who normally operate large amounts of orders enjoy all the perks at Bitfinex or Coinbase, a regular user’s (like yours truly) effort to cash out quickly smaller amounts of crypto might become a bit intimidating. In fact, it is smaller crypto exchanges that are now offering some pretty rare services and functionality that can make your daily crypto endeavours a little bit easier. Let’s explore some of them here.

Contents

Virtual vouchers for a fast and convenient cash-out

Sadly, but for now converting your crypto savings into fiat currency instantly nice and easy exists only in theory. If you use a traditional bank transfer scheme, the cash-out can take up to several days and might even cause a bit of nervous tension, since most banks are normally running a compliance check before accepting crypto payments. Another common way to get the cash out of crypto is via the likes of ww.bestchange.net, i.e. digital currency exchangers, yet again prepare to be waiting for a blockchain transaction confirmation. Moreover, the exchange rate is likely to be lower by at least by a few percent — and even more, if you’re cashing out when the market is seeing red. Cashing out by virtue of good old localbitcoins.net can also take up to several hours and a good deal of effort. Doesn’t it look like we’re having some sort of a ‘catch-22’ situation here?

We stumbled upon the solution literally by trial and error having noticed that a number of smaller exchanges offer their customers to generate special codes that allow fund transfers between user balances inside the exchange. Let’s say you sold bitcoins for $500 and instantly created code for this amount. Now any person who redeems it instantly receives $500 to their exchange balance. How does this help us? Well, some people want to cash out of crypto, while others want to buy coins and digital assets. So, by means of simple peer-to-peer exchange the funds inside the exchange are converted to the ’outside’ funds. The process is amazingly simple, and it looks like some exchanges are adapting this way into normal practice either buying or selling these ‘virtual cash vouchers’ to their customers.

Making use of this ultimate way you can cash out with an exchange voucher in literally 5 minutes and receive the funds to your good old e-payment system account at ADV Cash, Perfect Money, Payeer or other local services (we’re not talking PayPal here, as you might be discouraged by 7% commission rate):

Example for conversion EXMO USD to fiat at Bestchange.net

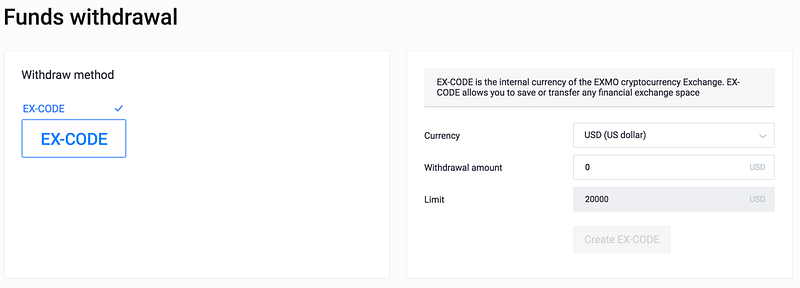

Among the exchanges offering a voucher service the most secure and best liquidity providers are probably WEX and EXMO. It is really very simple to generate an exchange code. With EXMO, for instance, the procedure looks like this:

Btc-alpha and Livecoin have also recently launched an analogue feature, yet unfortunately their codes aren’t widely accepted.

An opportunity to sell your crypto at higher prices

Curiously enough, but at some crypto exchanges you can sell your crypto at 2–5% higher than at Bitfinex or Binance. We’re not talking larger profit numbers here, however isn’t it nice to get some extra doe? Such thing happens due to deposit and withdrawal fees on the exchange side. For example, withdrawal fess to an e-money account or a Visa/Mastercard can reach up to crazy 2–5%! So how do you make extra profit? Just try using the virtual codes for withdrawals and sell them to digital currency exchanges! Let’s look at this example comparing prices at EXMO, WEX, Btc-alpha and Livecoin*:

| Exchange | Price for BTC/USD | Average BTC exchange rate valuation vs. major exchanges |

| Bitfinex | 6208 | 0% |

| EXMO | 6327** | + 1.9% |

| WEX | 6387 | + 2.8% |

| Livecoin | 6460 | + 4% |

*prices are taken from Coinmarketcap at 26/06/18

**for BTC/RUB, RUB can be instantly converted to USD on exchange

Note that only EXMO and WEX have really liquid and widely accepted virtual codes, that can be instantly converted to fiat money.

3. Stable coin to USD trading

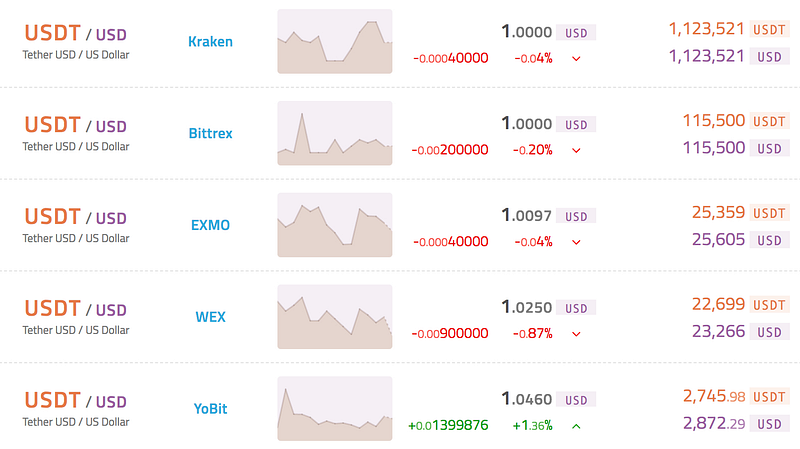

Every time the crypto market drops, it’s truly a nightmare for a ‘hodler’ who did not exit to fiat or otherwise to watch the value of their coins vanish — especially against USD. Now that the market is seeing red, it’s probably the best time to turn your attention to the stable coins like notoriously famous Tether or USDT. However controversial it might seem, it is widely accepted currency in the crypto community with huge trade volume according to Coinmarketcap reaching 4$ billion out of total market volume of about 17$ billion. Yes, you heard it right: Tether now is hitting 25% of total trading volume in the industry! It is crazy, but direct conversion of USDT to fiat money is very limited now and could be found only at several ‘boutique’ exchanges like Kraken, EXMO, WEX, Yobit, CEX-IO. At EXMO and WEX it is even possible to cash out 1 USDT for 1.01–1.03 USD:

USDT/USD markets. Data from https://www.coinhills.com/market/usdt-usd/

4. Variety of payments to e-money systems

Larger cryptocurrency exchanges either do not have crypto /fiat exchange options at all, or payment options are very limited, in most cases being limited to wire transfer or payment with huge commissions to one or two e-money systems. For example, at the moment top-5 exchanges by trade volume don’t have crypto/ USD! So, variety of withdrawal approaches to e-money and other easy-to-use systems are rather rare and valuable options a large crypto exchange can offer at the moment.

Smaller exchanges are winning over here too: EXMO and WEX now offer withdrawals to PerfectMoney, Payeer, ADVCash, E-pay, Skrill, MoneyPolo and some other e-money systems with a 1–3% commission. This amount sounds reasonable taking into account the convenience and higher coin prices compared to their larger counterparts.

Turns out, a boutique approach to crypto trading with exclusive services offered by smaller exchanges proves to be more inclusive and way more efficient than a ‘mass-market’ approach. Quick cash-outs via virtual codes, higher exchange rates, USD/USDT exchange option and avariety of e-money systems for fiat deposit / withdrawal. All of this can actually make your everyday crypto endeavors way more bearable.

Written by: Olga Grinina, Vasily Sumanov

This is a sponsored press release and does not necessarily reflect the opinions or views held by any employees of NullTX. This is not investment, trading, or gambling advice. Always conduct your own independent research.