In the ever-evolving landscape of cryptocurrency, few sectors have seen as much development and innovation as decentralized finance (DeFi). One notable player in this space is Curve Finance (CRV), a decentralized exchange focused on stablecoins. Recently, CRV has seen a substantial increase in accumulation, raising eyebrows in the crypto community.

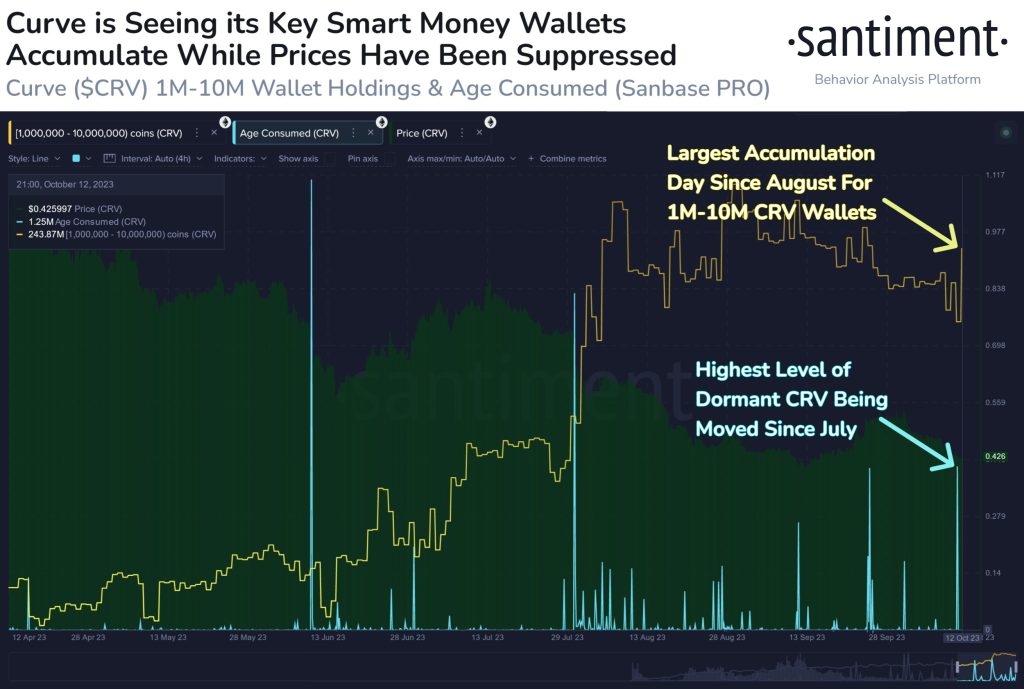

Source: Santiment

The CRV Accumulation Surge

In the last 24 hours, large-scale cryptocurrency holders, often referred to as “whales” or “sharks,” have exhibited a considerable appetite for CRV tokens. Specifically, the 1 million to 10 million CRV token range has observed a significant increase in holdings, surging by approximately 9.5%. In dollar terms, this represents a hefty $9.5 million added to their collective CRV bags.

What’s particularly intriguing about this accumulation is the active participation of dormant wallets. These accounts have remained relatively inactive for an extended period. However, over the last 24 hours, they’ve sprung into action, marking their highest level of activity since July.

Interpreting the Data

Such a substantial accumulation of CRV tokens by both large holders and previously dormant wallets raises questions about the driving forces behind this surge. Several possibilities come to mind:

- Strategic Investment: Large cryptocurrency holders might be making a strategic investment in CRV, expecting favorable price movements in the near future.

- Market Sentiment: Positive market sentiment or insider information could be driving increased interest in CRV.

- Yield Farming: DeFi projects often offer opportunities for yield farming, allowing users to earn rewards by providing liquidity to the platform. The accumulation could be linked to yield farming strategies.

- Participation in Governance: CRV token holders play a vital role in the governance of the Curve Finance protocol. Increased accumulation might indicate a desire to influence or participate in governance decisions.

- Speculation: Some may be accumulating CRV purely for speculative purposes, hoping to capitalize on potential price appreciation.

It’s important to note that cryptocurrency markets are highly dynamic, and various factors can drive these kinds of moves. As with any investment, individuals should perform their research and consider the inherent risks.

Conclusion

Curve Finance’s CRV token has experienced a remarkable surge in accumulation, particularly in the 1 million to 10 million token range. This surge, accompanied by the heightened activity of dormant wallets, has captured the attention of the crypto community. Understanding the motivations behind these moves remains a matter of speculation, but it highlights the vibrant and rapidly evolving nature of the DeFi sector. In the world of cryptocurrencies, staying informed and being prepared for the unexpected is a fundamental aspect of prudent investment.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Image Source: karnoff/123RF // Image Effects by Colorcinch