It’s been a gloomy week for the crypto community in India. After three months of waiting for the Supreme Court to make a ruling on the petitions against the RBI’s directive in April, it finally happened on July 3. The country’s highest court upheld the RBI’s directive that required all financial institutions to exit all relationships they had with crypto-related businesses or individuals. This appeared likely to deny the crypto community access to basic financial services, one of which was the conversion of cryptocurrency to fiat money. One day after the ruling, the ban has claimed its first victim.

The First of Many?

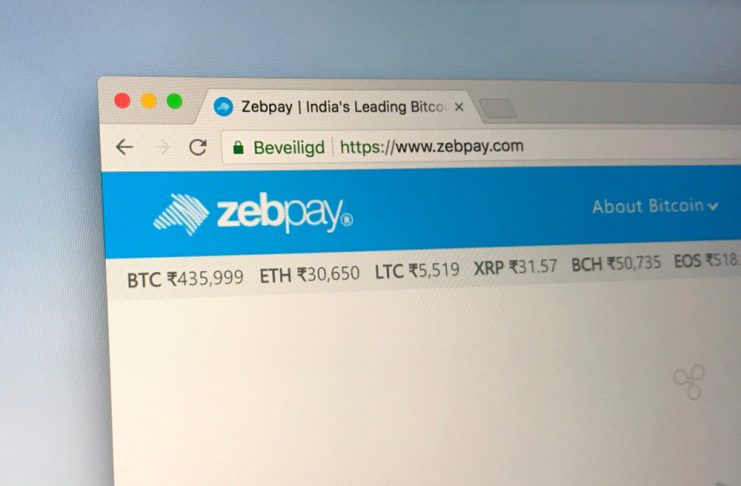

Zebpay, one of the most popular crypto exchanges in India, has finally halted all fiat deposits and withdrawals on its platform. The exchange will continue offering other services such as crypto-to-crypto trading and crypto withdrawals. Earlier in June, the exchange issued a warning to its users that in light of the RBI’s ban, fiat transactions might become significantly more difficult in the future. Those who stored fiat currency in their accounts were advised to withdraw it or risk being unable to do so once the exchange’s bank accounts were disrupted. Zebpay promised it would endeavor to return all the fiat money before the ban took effect but warned its clients that if its accounts were disrupted before then, it would be indemnified.

Indian crypto exchanges have already begun making plans to move their operations to more crypto-friendly jurisdictions even as they continue to plead their case to the Reserve Bank. According to Shubham Yadav, the co-founder of the Coindelta exchange, India has become impossible to operate in, and Coindelta will have to set up shop elsewhere or risk shutting down. Speaking to Quartz, Yadav said:

It won’t be possible for us to function in the current regulatory environment with existing business models. Therefore, several firms are looking at registering their head offices out of India.

Singapore is one of the destinations most exchanges are eying. With a thriving economy, a developed financial services industry, crypto-friendly regulation, and its close proximity to India, Singapore is an ideal country for exchanges. Other locations that exchanges are reported to be considering include Estonia, Dubai, Switzerland, and Malta.

While relocating may address the regulatory barrier, not many exchanges can afford to do so, according to Anirudh Rastogi, a lawyer representing some of the petitioning exchanges. Smaller exchanges may face imminent closure unless the regulator reverses the ban.

Shifting the operation to another country is an expensive as well as taxing proposition. Similarly, re-inventing the whole business model also won’t be easy. Therefore, only bigger firms with better financials will find it worthwhile to restructure their businesses and will survive.

The ban will open up a huge market opportunity for peer-to-peer crypto exchanges, however. These exchanges have no central authority and only provide a platform in which people connect, but transactions usually take place offline. Without a central authority, theft and money laundering can’t be kept in check. Moreover, clients aren’t assured that those with whom they transact will keep up their end of the bargain. While the RBI’s ban may have been in good faith, it could end up opening a Pandora’s box that could accelerate the use of cryptos in money laundering and other criminal activities.

Image(s): Shutterstock.com