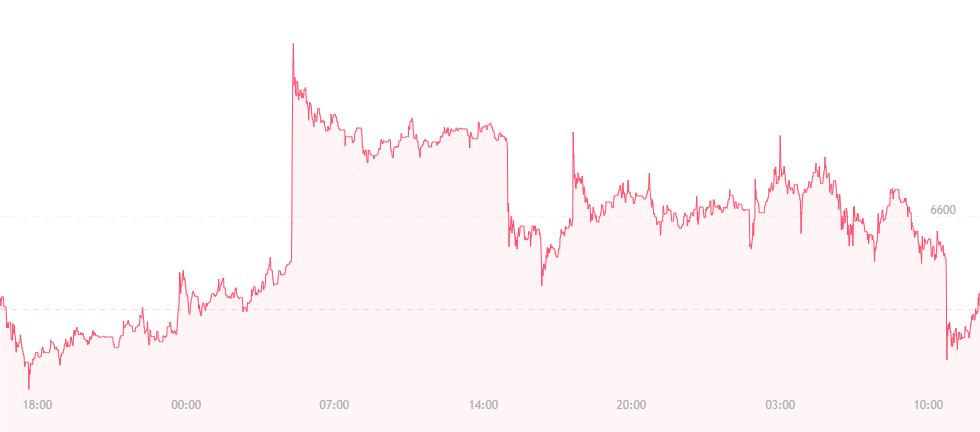

At press time, the father of cryptocurrencies has dropped down to about $6,400. That is roughly $200 less than where it stood yesterday afternoon.

Enthusiasts everywhere were pleasantly surprised to see the currency spike to $6,600 just prior to the start of the week. However, things began looking a little worrisome when $6,500 entered the mix, and bitcoin fell by approximately $100 within 24 hours. Later, bitcoin struck home and jumped to $6,600 again, but it is now down by $200.

It appears maybe traders don’t have to be too worried just yet. Bitcoin is likely going through mild changes and corrections over this seven-day period as it attempts to recover from the $5,800 mark it struck last week. A drastic drop like that is sure to put a dent in bitcoin’s plans, and it probably needs time to fix itself.

However, where some investors are losing confidence is in the year-end price. For several months, Fundstrat analyst Tom Lee – who has been one of bitcoin’s primary bulls – has insisted that the currency would end 2018 at a price of roughly $25,000. Despite the endless swings and volatility, Lee has stuck to his guns and his prediction.

Now, the financial expert is backtracking a bit. While he still believes bitcoin could end the year at over $20,000, he’s not as confident in $25,000, and he’s pulling his prediction back by roughly 20 percent. He now explains that bitcoin will end 2018 at a price of around $22,000.

“Bitcoin has historically traded at 2.5 times its mining costs,” he states. “It is not out of the question that it could still be over $20,000 by the end of the year at fair value.”

He says investors need not concern themselves with the difference of a few thousand dollars, and that any return to the $20,000 mark or beyond would increase a person’s bitcoin earnings by roughly 200 percent.

“Cryptocurrency miners use high-powered computers that use a lot of electricity to complete a series of complex calculations to create a bitcoin,” he explains. “The reason bitcoin looks so good here is the cost of mining is around $7,000 fully loaded, and the difficulty is rising, so by the end of the year, it’s going to be $9,000 at least.”

This would constitute a $2,000 in mining costs in less than six months, and bitcoin has proven itself to be relatively unpredictable over the past few years, incurring massive jumps from low positions and then massive low points from high positions. Thus, maybe it’s near impossible to put a year-end price stamp on something that refuses to play by the rules. Still, Lee remains adamant five-figures is within reach.

Image(s): Shutterstock.com