by Shigeru, CGV FoF Research Fellow

The most fascinating thing about the encryption industry is that it is never short of innovative narratives.

In the first quarter of 2022, although the encryption industry had been affected by uncertainties such as the Ukraine-Russia war and the Fed’s interest rate hike expectations, the continued popularity of “Move-to-Earn” projects such as STEPN and Genopets gave a boost to the entire industry. The “Move-to-Earn” mode was quickly recognized by users and well received by the market.

Move-to-Earn is similar to Play-to-Earn. Put simply, real physical movement data is tracked through a smartphone or wearable device and mapped into the project. If certain task requirements are met, players can obtain corresponding rewards. For example, in a running application, users can obtain token rewards if they meet a task requirement of, say, 5,000 steps.

CGV Research has conducted an in-depth analysis and discussion on the “Move-to-Earn” mode and representative projects. We are very excited about the bold exploration and practice of STEPN and other projects in the fields of Web3, encryption, and traditional markets. We firmly believe that the Move-to-Earn track is a brand-new track that is different from other X-to-Earn tracks. It has just started and will become a huge blue ocean market in the future.

Contents

Fitness: An Excellent Scenario for Web3 Encrypted Applications to Reach Beyond the Circle

For practitioners in the encryption industry, how to apply encryption technology to Web3 so that more users can access encrypted applications and encrypted digital assets is one of the difficult problems they have been trying to solve. After all, only when new users enter the encryption industry and take up the business of a new market can the encryption market grow bigger.

Many fields such as education, socializing, and entertainment have been trying to adopt the combination of Web3 and encryption technology. But in the view of CGV, the fitness market that Move-to-Earn relies on has a broader user base and room for development. Fitness may be an excellent scenario for Web3 encrypted applications to reach beyond the circle at this stage.

Fitness is a form of communication across borders, races, religions, and cultures. Just as the Olympic spirit “faster, higher and stronger” advocates, fitness is the universal value of human society. In terms of statistics, the people engaged in fitness constitute a huge user group: more than 1 billion people choose walking, jogging, or running as a form of exercise; the number of users of running applications worldwide reaches 400 million; and in 2021, the number of people engaged in fitness in China exceeds 3 billion, etc. If Move-to-Earn can turn people engaged in fitness into users, it can attract millions, and even tens of millions of people, into the Web3 and encryption market.

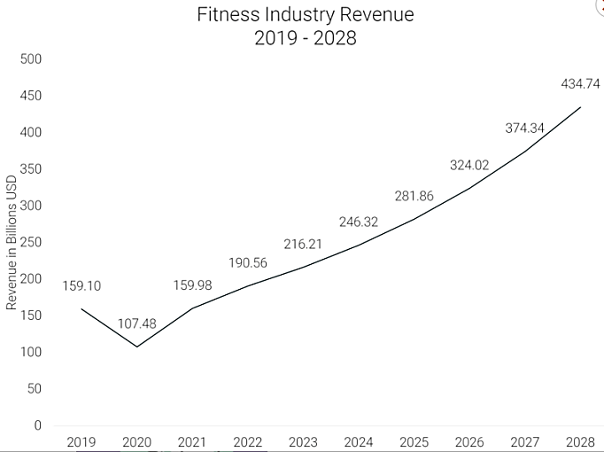

Global Fitness Market Revenue Scale Forecast (2019–2028) Source: Runrepeat

Online fitness market grows rapidly. Since the outbreak of COVID-19 in 2020, more and more people have paid attention to health and adopted new ways of fitness. Online fitness has become the first choice for users thanks to its convenience, data-based monitoring effects, and dynamic usage analysis. According to Runrepeat, the global online fitness market is expected to reach $59.231 billion by 2027, growing at a CAGR of 33.1% from 2020 to 2027. Users of online fitness applications are all potential users of Move-to-Earn.

Fitness is in line with the era theme of carbon neutrality and environmental protection. The original intention of the Move-to-Earn project is to encourage users to engage more in fitness. While exercising, they also indirectly participate in environmental protection, making their own contributions to the advancement of the global carbon neutrality cause. For example, users can walk for 30 minutes to work instead of driving for 10 minutes. It is believed that the low-carbon lifestyle advocated by Move-to-Earn will be accepted by more people.

Experiences and lessons about Web2 fitness applications. Web2 fitness application is already a big market. As the market demand for smart watches and wearable devices keeps increasing, App developers constantly introduce new tools and functions, boosting the market vitality of fitness application software. Here, a running App “Interesting Walking Chain” (IWC) is worth mentioning. It was established in June 2018, and the number of registered users in China alone once exceeded 70 million. But its core business mode is a Ponzi scheme that pays dividends to existing investors with funds collected from new investors, and the project ended in abscondence with the money. Although IWC is a negative example, it can be seen from the development trajectory that once the door of the Move-to-Earn fitness market is opened, there will be a large influx of users.

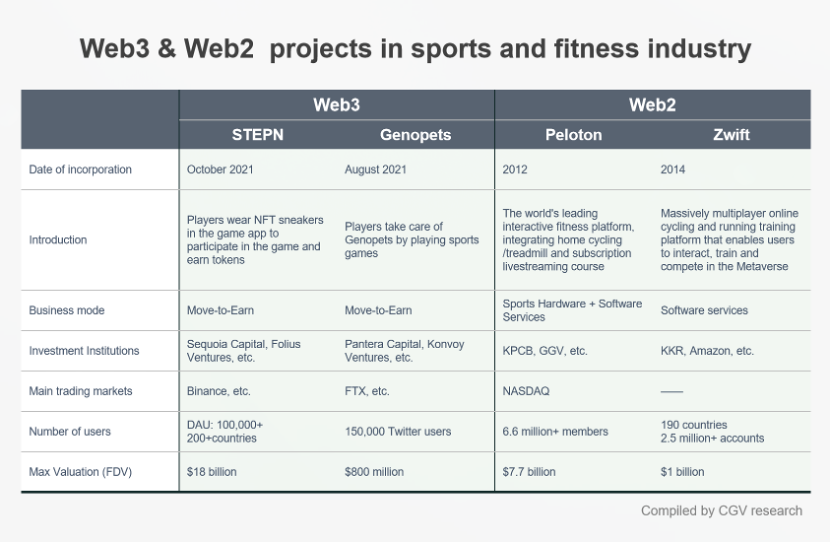

Web3 & Web2 projects in sports and fitness industry

Market gap and user needs of the fitness market are clear. From CGV’s point of view, users who have a demand for fitness App can be roughly divided into two categories. The first category is users who have fitness plans but have difficulty adhering to them. For many people who have a fitness plan, their subjective willingness and enthusiasm to exercise may not be strong, and therefore it is not easy to stick to the habit, resulting in unsatisfactory fitness effect. Appropriate incentive feedback can help individuals stick to the plan. The second category is users who have cultivated fitness habits. For fitness enthusiasts, the additional benefits generated by exercising can help them develop new behavioral habits and maintain a certain stickiness to the habits.

For those users who have already reaped benefits in the Play-to-Earn mode, they will certainly hope to earn more in the new Move-to-Earn mode. This group of users will also be important participants in the Move-to-Earn mode.

Move-to-Earn does not Belong to, nor is it Equal to Play-to-Earn

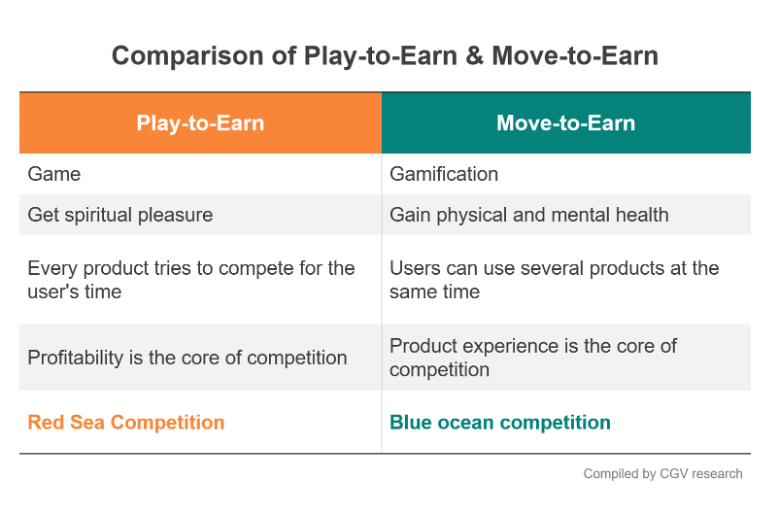

In the encryption circle, many media and KOL tend to classify Move-to-Earn into the GameFi market category, and even equate it to a variant or derivative of Play-to-Earn.

However, after comparing game attributes, user habits, product competition, and the ultimate user experience, CGV Research believes that Move-to-Earn does not belong to, nor is it equal to Play-to-Earn. The two are quite different from each other in the following aspects:

First, one is game, while the other is gamified product.

Whether it’s Axie Infinity’s hyperbolic token economic model, Loot’s unique “bottom-up” game narrative, or StarAtlas’ spectacular interface and engine, these projects are typical of Play-to-Earn. Play-to-Earn encourages players to earn income through games, that is, players provide labor (in the form of time and energy devoted into the game) and capital (usually need to buy NFT to participate in the game), and obtain token rewards after making achievements and progress in the game.

Game is addictive, and many GameFi games have complicated rules that make the game difficult to understand and play. Gamification is a form of expression that is different from game but adopts game rules. In other words, gamification is just a feedback effect logic extracted from game rules.

Advocating investing in health, the Move-to-Earn project develops products and operates them with the idea of “gamification”. When designing and developing many Move-to-Earn products, it is necessary to strike a balance between gamification, token economy and App operation. In this case, developers will further weaken the elements of game, because they can make the game difficult to understand or operate.

Second, one competes for user play time, while the other competes for unit time efficiency.

For the Play-to-Earn project, if you choose to play Axie, you basically cannot play other games at the same time, and the total amount of time each player spends on the game is limited. As one needs to work and sleep with only a few hours left for game, very few people can play 2 or 3 games well.

For the Move-to-Earn project, if you have chosen application A, you can still choose application B at the same time and get more benefits. Let’s call it the “double mining” of fitness mining. Just imagine, when you are running, you can get two, three or even more benefits at the same time, and all you need to do is to keep a few applications running at the background. So, why not?

Here is a simple example to help you understand: the competition between Play-to-Earn projects is similar to that between Facebook and TikTok; while the competition between Move-to-Earn projects is similar to that between Ethereum mining machine and ETC mining machine.

The core difference between the two is as below. Play-to-Earn competes for the total amount of user play time, which belongs to competition in the existing market (everyone’s leisure time for game is limited). In this case, rate of return is the key to competition as high rate of return helps to win more users. While Move-to-Earn competes for the efficiency of user unit time, which belongs to competition in the new market (no upper limit on the number of superimposed products per unit of time). In this case, product experience is the key to competition as a good product experience can help users cultivate usage habits.

In accordance with the above logic, the room for market growth of Move-to-Earn (maybe several times, even dozens of times) is much larger than that of Play-to-Earn.

Third, one pursues fitness, while the other pursues spiritual pleasure.

The carrier of Play-to-Earn is the game, which requires players to stare at the screen for a long time and perform manual operations. In addition to the token income, there is also spiritual pleasure. But in fact, Play-to-Earn leaves players with more tedious click of pages designed with almost the same mechanism than joy in the game itself.

Move-to-Earn frees the player’s hands and eyes, and fully mobilizes the user’s enthusiasm for movement. Regardless of the benefits, the effects of physical exercise are real. However, users of some Move-to-Earn projects “exercise too much”, resulting in problems such as broken feet, knee injuries, muscle strains, etc.

In addition, although the effects of fitness and spiritual pleasure are all difficult to quantify, the social resistance encountered by each user is completely different. Your family or friends will understand and encourage you to engage in fitness, but if you keep playing games, I believe it is more likely that people around you will persuade you not to “indulge in games”, even if you argue “I’m not playing games, I’m making money. “

Where’s the Room for Move-to-Earn Rivals after STEPN Became Popular?

When it comes to Move-to-Earn in 2022, we have to mention STEPN. Objectively speaking, without the explosive growth of STEPN, the Move-to-Earn track may not have aroused public attention so quickly.

The CGV team has prepared some public market data to give a brief review of STEPN’s short but glorious history:

In January 2022, as the first Move-to-Earn NFT game on Solana, STEPN announced the completion of a $5 million seed round with Sequoia Capital India and Folius Ventures as lead investors, making it a big name for a while; in March, Binance Launchpad announced the launch of STEPN governance token GMT. In less than a month (as of this writing), the price of GMT rose from $0.001 to $2.8, an increase of about 280 times, and the peak FDV exceeded $16 billion.

Just seeing these numbers, many people will unconsciously classify STEPN as a type of project controlled or coerced by capital giants, but in fact, as CGV noticed, more details that may not be paid attention to seem to be uncommon in the encryption circle:

— — STEPN’s App once ranked fourth in the Japanese application market, and third among US fitness Apps;

— — In the two weeks from March 16th to 30th, the number of token GST addresses consumed by STEPN increased from 31k to 78k;

— — STEPN governance token GMT surpassed BTC in 24-hour trading volume on Binance Exchange on March 30.

To sum up, both operational data and transaction data reflect the strong momentum of STEPN’s further development. No wonder Scott Dunlap, vice president of Adidas, praised STEPN many times on social media: “STEPN will become the dark horse of the industry in 2022” and “more people will be obsessed with STEPN”.

In my opinion, STEPN’s success today can be attributed to the convergence of developments in blockchain underlying technology, token economic system, NFT market, etc. and it fully enjoys the dividends of the development of the encryption industry.

First, it is based on the latest development of the blockchain infrastructure layer.

One example is the improvement of public chain performance. The Solana public chain preferred by STEPN is known for its high scalability, fast execution speed and low cost. This guarantees reliable interaction of STEPN functional modules, NFT and digital assets, and ensures a smooth user experience. This undoubtedly greatly narrows the user experience gap between Web2 and Web3.

Just imagine, if STEPN was launched directly on Ethereum two years ago, repairing a sneaker would cost 30 minutes to execute command, and dozens of dollars. How discouraging?

Second, it is based on the development of the dual-token model and economic system design of Play-to-Earn.

As the representative of Play-to-Earn, Axie has created a dual-token model and economic system design. If you’ve played so-called free mobile games, you’ll understand the gold and diamond system. Gold coins are not valuable, diamonds are the real scarcity, you have to work very hard to get them, or you can buy diamonds directly with fiat currency.

One of the most interesting parts of STEPN’s profit model is the dual token system. The logic of gold coins and diamonds is replaced by GST and GMT respectively. While players can get both, GMT is in limited supply, of higher value, and more difficult to acquire. In contrast, GST is the fuel that players consume to do different tasks in the game.

Third, it is based on the continuous explosive growth of the NFT market and the extensive education of users.

In 2021, driven by factors such as celebrity effects (such as Madonna and other stars buying Bored Apes for more than $500,000) and the popularity of metaverse, the collection of digital avatars became hugely popular and ignite the entire NFT market. According to NonFungible data, the transaction volume of NFT reached $17.6 billion in 2021, a 210-fold increase from $82 million in 2020.

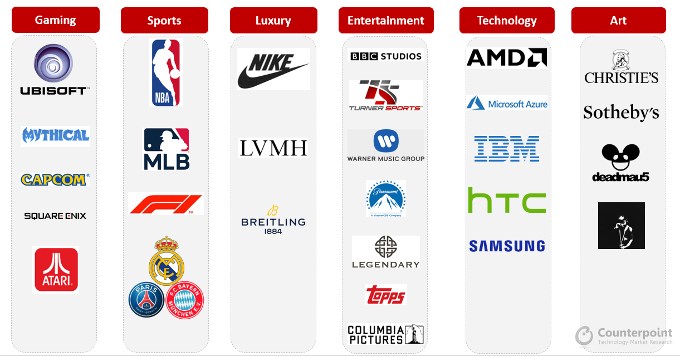

NFT energy is intoxicating. Numerous startups, multinational corporations, A-listers, Hollywood studios and many others came together to discuss and celebrate the disruptive potential of NFT in their respective fields. And today, this trend shows no sign of slowing down.

Traditional commercial brands that have explored NFT business Source: Counterpoint Research

If there is no explosive growth of NFT project and NFT market education, how difficult it would be to convince a user to spend nearly 1,000 US dollars to buy a pair of virtual NFT running shoes, and that two pairs of running shoes would mint new running shoes? You know, until 2021, they all seem to be ridiculous jokes.

The popularity of STEPN has stimulated many competing products. However, no single project can monopolize a track. STEPN also has its own “Achilles’ heel” and it’s not perfect.

CGV believes that new breakthroughs may be possible in the following directions for Move-to-Earn competitors:

First, duplicate STEPN. It sounds bizarre, but think twice, and it seems to be a probably feasible direction. As mentioned above, in the “Move-to-Earn App” mode, when two mining machines (Move-to-Earn App) of the same model and power are powered on at the same time, the benefits are superimposed with no influence on each other.

Second, support more scenarios. STEPN currently only supports limited outdoor fitness scenarios such as walking and running. It needs to be connected to the GPS system. It does not cover outdoor scenarios such as cycling, mountaineering, and skiing. It also cannot support related data for indoor fitness such as treadmill exercise, etc. These are all potential opportunities.

Third, lower the threshold for users to use. At present, STEPN users entering the world of Move-to-Earn need to spend at least 800U to buy shoes, which is not a small expense for many users. If they can experience the App with a cost equal to a few cups of coffee, it will be easier for them to get involved. Although STEPN plans to enable rental function, no specific details have been revealed yet, and we will continue to keep an eye on that.

In addition, it is also very important to develop more ways of interaction between fitness and socializing. CGV believes that Move-to-Earn may be the easiest way to get to SociaFi. The generated data pictures of fitness App visualize the fitness. Social platforms such as Facebook and Instagram provide a coordinated self-display stage for the fitness population. Therefore, the combination of fitness with socializing will bring huge user stickiness and faster fission speed to the Move-to-Earn project.

Move-to-Earn’s “First Half” Risks and “Second Half” Opportunities

Whether it’s GameFi, Play-to-Earn project, or X-to-Earn project, they all have their own cycles, ranging from weeks to months or even years. Will the Move-to-Earn project be a “flash in the pan” as the popularity drops, prices drop, old players get bored, or numerous imitations pop up?

CGV believes that the development and effective operation of the economic system is the key for the Move-to-Earn project to making breakthroughs in the bottleneck period and further opening up new prospects.

In a simple analogy, we can compare the economic system to a cistern. If the amount of water flowing into the cistern (the total cost of the user for the project) exceeds that of the water flowing out of the cistern (the total revenue the user gets from the project), the economic system can rely on internal circulation for continued functioning.

In the same way, for a certain Move-to-Earn project, if there are more users who make money than users who spend money, then this is a game of “left foot on right foot” in which the money earned by users must be the money lost by latecomers.

In addition, the speed of water flowing in and out needs to be strictly controlled to prevent the water from flowing out too fast within a certain period of time and causing the reservoir to dry up.

The root cause of the failure of previous projects such as IWC also follows the above logic. The gameplay of IWC is that players need to invest in scrolls and generate candy tokens through scrolls and activity. At the end, the game became a relay race to attract more latecomers. Candy tokens were continuously issued without consumption scenes, and as a result, the price fell sharply, resulting in stampede collapses and the reservoir dried up.

For projects that adopt the “dual currency mode” such as Axie and STEPN, in terms of economic model, the balance mechanism of token minting and destruction is gradually explored, which provides an important foundation for the inflow and outflow control of the water speed of the reservoir.

For example, STEPN creates a variety of scenarios for the consumption of GST tokens and governance tokens GMT to facilitate use, such as using GST to upgrade shoes, speed up the upgrade time, repair shoes, synthesize new shoes, etc.; at the same time, control the output of GST and GMT to reduce selling pressure. It is difficult for players to simply seek rent through mining and selling, and asset returns are implicitly limited and diversified. This prevents the project from falling into a death spiral to a certain extent.

CGV believes that the Move-to-Earn boom has just begun, and the “second half” of Move-to-Earn is about to start. In the next few months or 1–2 years, we may see the following new changes:

The first encrypted application with tens of millions of users will be born. In 2022, the trend of Move-to-Earn will sweep across the entire Web2 and Web3 fields. Whether it is encryption users, fitness experts, or KOL from all walks of life, they will all be moving with this trend and will spontaneously promote it. Play-to-Earn’s Axie was once very popular in 2021, capturing millions of users, and Move-to-Earn’s users will greatly exceed that number. After all, the number of people walking and running is much larger than that of people who play krypton gold games.

ASICS is the first sportswear brand to enter the NFT field

“Fitness as mining” has become the classic mode of X-to-Earn. Fitness may be the best application scenario for X-to-Earn. The Move-to-Earn mode makes the concept of “fitness as mining” popular with the people. Coupled with the exploration and practice of a series of applications represented by STEPN in the token economic model, it has set an example for more scenarios to explore the X-to-Earn mode. At the same time, as more Move-to-Earn projects will be launched, they will provide users with more diverse and personalized options for fitness incentive “mining machine”.

The cooperation between encrypted applications and traditional business has entered a new chapter. The encryption movement is rapidly entering mainstream business. Not only are traditional financial institutions investing capital in crypto assets, but many mainstream consumer brands are embracing NFT, such as Visa buying CryptoPunk, and Coca-Cola and McDonald’s launching NFT souvenirs. The Move-to-Earn application scenario is not only applicable to traditional business partners such as fitness hardware, App, clothing and apparel brands, and luxury fashion brands, but also fully integrates encryption economic elements such as NFT and encrypted assets, opening up new possibilities for the cooperation between traditional business and encrypted applications.

A16z co-founder Chris Dixon said more than a decade ago that “the next big thing will start out looking like a toy.”

Move is boring and repetitive, but Move-to-Earn is a kaleidoscope.

Perhaps, we can catch a glimpse of the prototype of the “next big thing” Web3 application from the innovation of Move-to-Earn.

CFG FoF Links:

Website: www.cgv.fund

Twitter:https://twitter.com/CGVFOF

Medium:https://medium.com/@CGVFoF

About CGV FoF: CGV FoF is an Asia-based Fund of Funds (FoF) that focuses on investments in Crypto Fund and Crypto Studio. CGV FoF is composed of family funds from Japan, Korea, and China’s mainland and Taiwan, with headquarters in Japan and branches in Singapore and Canada.