With the explosion of decentralised finance products hitting the market have come a variety of decentralised loan providers. However, most products have critical flaws, such as low fund utilisation due to over-collateralisation and significant risk issues caused by protocol design.

To address these issues, Definex (https://definex.io/), a new decentralised loan and insurance ecosystem, uses insurance protocols to provide a balance between fund security and efficiency. The project was awarded the Polka Grant by blockchain protocol Polkadot in 2019 and is ready for launch this year.

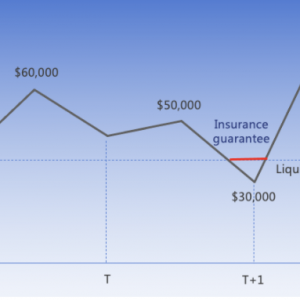

Decentralised loan products generally work by providing collateral, which can be liquidated in times of market volatility, even though the collateral may later soar above its initial price. However, with an insurance-based model, the insurer can give an extra buffer amount to cover your back.

Insurance premium prices will depend largely on the volatility rate, term structure, and liquidation price. The larger the spread between the liquidation and pledge prices, the smaller the premium; higher premiums will be charged where the spread is smaller.

Definex will launch its TestNet in Q3 of 2021, followed by the launch of its deposit, lending, and clearing functions. Other loan and insurance functions will then be live towards the end of the year. After this, Definex will work on cross-platform compatibility and improve its governance, including mechanisms to add new assets, change interest rate models, parameters, variables, and more.

Image(s): Shutterstock.com