Throughout the year 2020, there has been a strong focus on decentralized finance. At the same time, a lot of traders flocked to decentralized exchanges, primarily those embracing the AMM model. Polkadex aims to go to the next level through its Fluid Switch Protocol.

Contents

Decentralized Exchanges Need to Evolve

In recent months, there have been a lot of projects seemingly mimicking the successful model of Uniswap. As Uniswap remains the largest decentralized exchange in terms of trading volume, that is not entirely surprising. However, simply copying a working idea is never ideal. With dozens of platforms now using the same AMM (Automated Market Maker) model, there has been a lack of innovation in the industry. This leads to far less trading volume passing through these platforms.

This makes some people wonder if decentralized exchanges can even be the “next big thing” for trading cryptocurrencies. While the AMM model has some merit on paper, there are other options to explore as well. Combined with increasing transaction costs and slow transactions, the model of using AMM – especially on Ethereum – will become counterproductive after a while.

Granted, I have experimented with off-chain order books, as they offer a speed increase. Unfortunately, they severely lack transparency, making it a far less prominent solution. There have to be better ways to not only maintain current liquidity, but also tap into explored sources of liquid assets. During my research, I came across Polkadex.

Why Polkadex is Different

The main selling point of Polkadex is its Fluid Switch Protocol (FSP). Unlike most DEXes, it uses an order book, but one that is fully supported by an AMM pool. This unlocks a lot of new possibilities for the future. One option is to tap into unexplored liquidity and achieve a far more efficient trading experience.

While the Polkadex team is working on such an engine, it still requires a bit more work. That is something they can keep working on, simply because the core concept of Polkadex is good. Any incoming order is matched against the order book, but if the engine can’t find a match, it will go through the AMM pool. As a result, there is far more liquidity, as well as potential arbitrage options to be explored.

Personally, I have incredibly high expectations for these arbitrage opportunities. Being able to access them in a completely different setting than what traditional DEXes provide today will introduce a lot of benefits for traders such as myself. One can only hope the Polkadex team will be able to build a trading engine capable of meeting expectations.

Addressing Liquidity Restrictions

To power the Polkadex service, there needs to be ample liquidity. Traders have multiple options: either through the Polkadot-to-Polkadex parachain, or by using the Snowfork trustless bridge. This latter option bridges liquidity between the Substrate and Ethereum ecosystem. While still in development, I can see a lot of benefits in this approach.

Having the option to lock assets on Ethereum through smart contracts and bridging liquidity to Polkadex without relying on middlemen is a game changer. It also provides traders with peace of mind, as there are no concerns regarding the exchange getting hacked or anyone accessing funds inappropriately. A more than welcome change of pace from centralized platforms, as well as the issues affecting decentralized exchanges.

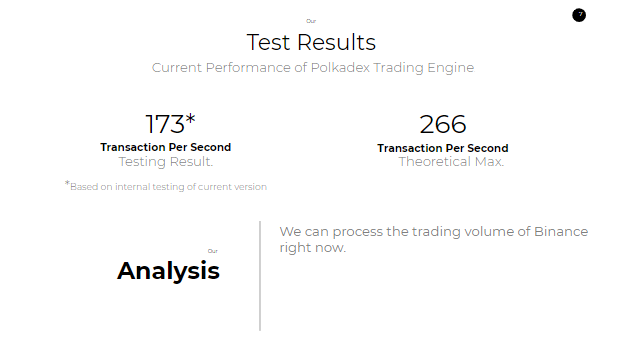

Higher TPS = Better Experience

Compared to current DEXes, Polkadex will blow the competition out of the water in terms of throughput. Internal testing has shown that Polkadex can achieve 173 transactions per second, with the potential to reach 266 transactions per second at peak performance. This is on par with Binance’s trading volume, but everything happens in a completely decentralized and trustless manner.

It has to be said, the Polkadex team is very ambitious. They expect to obtain a 5% market share from centralized exchanges and 25% market share from decentralized exchanges in the first year. That equals to $36.5 million in revenue by 2022, or $100 million in daily trading volume. Personally, I see no reason why these numbers can’t be hit. This approach is unique, extremely powerful, and seems to address issues one will experience when using other trading platforms.

Conclusion

All of the above is enough to get me excited about Polkadex already. While decentralized exchanges have potential, the stagnation in terms of innovation is unacceptable. As long as they remain focused on Ethereum, that situation will not change either. Polkadot, on the other hand, seems to be a more suitable ecosystem for higher-frequency trading.

To make things even more interesting, the team is intent on enabling additional features. These include lending, margin trading, a dark pool, and futures and options. It makes for a complete package capable of checking all the right boxes for cryptocurrency traders and enthusiasts.

Image(s): Shutterstock.com